Algoritem za overovitev transakcij z bitcoini je neverjetno računsko in energetsko potraten. Bitcoin transakcija tako porabi, po oceni iz l. 2015, približno 5000 krat več energije kot transakcija z uporabo Visa kreditne kartice.

Koliko električne energije torej trenutno gre za rudarjenje bitcoinov? Po oceni Digiconomist.net je ta na letni ravni trenutno kar strašljiva – primerljiva s porabo električne energije celotne Danske. V oceni Digiconomist.net je glavna predpostavka ekonomska, da namreč bitcoin rudniki okoli 60% svojega dohodka porabijo za operativne stroške. To se sliši kar smiselno, saj primer energijsko učinkovitega novega rudnika na Kitajskem kaže na okoli 20% operativne stroške za električno energijo, kar je verjetno spodnja meja. Po tej oceni gre tako 0.15% globalne proizvodnje električne energije za rudarjenje bitcoinov…

Nekaj izsekov iz “A Deep Dive in a Real-World Bitcoin Mine” na Digiconomist.net

The 21,000 Bitcoin mining machines represented “nearly 4% of the processing power in the global Bitcoin network” at the time, and together with the Litecoin mining machines the mine generates about $250,000 in revenue daily. The mining machines are powered with electricity coming mostly from the nearby coal-fired power plants, and costing only four cents per kilowatt-hour after a 30% discount by the local government. In exchange for this discount, the profit from the mine is taxed. The total daily electricity bill amounts to roughly $39,000, meaning the facility consumes around 40 megawatts of electricity per hour.

Bitmain’s Inner Mongolia mine teaches us that the carbon footprint of a single Bitcoin transaction could be equal to that of being a passenger during one hour of flying a Boeing 747-400, or driving a Hummer for 200 kilometers (~120 miles).

Izseki iz “Bitcoin Energy Consumption Index” na Digiconomist.net:

Number of U.S. households that could be powered by Bitcoin: 3,030,415

Number of U.S. households powered for 1 day by the electricity consumed for a single transaction: 7.93

Bitcoin’s electricity consumption as a percentage of the world’s electricity consumption: 0.15%

To put the energy consumed by the Bitcoin network into perspective we can compare it to another payment system like VISA for example. Even though the available information on VISA’s energy consumption is limited, we can establish that the data centers that process VISA’s transactions consume energy equal to that of 50,000 U.S. households. We also know VISA processed 82.3 billion transactions in 2016. With the help of these numbers, it is possible to compare both networks and show that Bitcoin is extremely more energy intensive per transaction than VISA.

Izsek iz “The Ridiculous Amount of Energy It Takes to Run Bitcoin” na IEEE Spectrum:

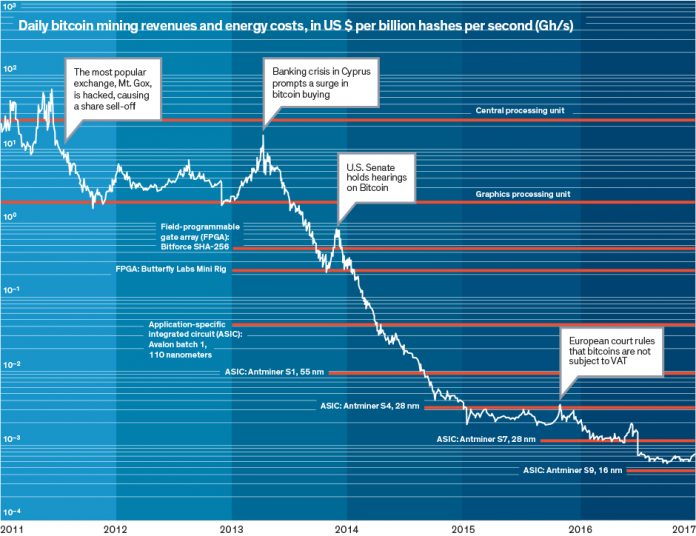

Vranken says doing today’s calculations would “consume way more power than is generated on the entire planet” if it were done using the CPUs available when Bitcoin launched in 2009. What has prevented such disruption is a series of hardware upgrades: Miners began abandoning the CPU for the more-efficient graphics processing unit around 2011, and by 2013, chipmakers were producing application-specific integrated circuits (ASICs) just for bitcoin mining.

Today’s state-of-the-art Bitcoin ASICs complete a 256-bit hash 100 million times as fast and with one-millionth the energy of a 2009-vintage CPU, Vranken says. Yet more efficiency gains are possible by optimizing data centers from the ground up to power and cool bitcoin-mining ASICs [PDF] [see “Why the Biggest Bitcoin Mines Are in China,” coming soon in this issue].

The problem is that chip efficiency gains are slowing [see “Moore’s Law Might Be Slowing Down, But Not Energy Efficiency,” IEEE Spectrum, April 2015] and, according to Vranken, are losing ground against Bitcoin’s exponentially rising exchange rate and rates of hash computation. Another Dutch researcher, Sebastiaan Deetman, says an “enormous increase in hash rate” over the last year or so has likely pushed Bitcoin’s global draw closer to 700 MW.

And if the hash computations accelerate further? In that case, Deetman, who is a doctoral candidate in industrial ecology at Leiden University, sees Bitcoin power demand ballooning 20-fold—to 14 gigawatts—by 2020. If that happens, Bitcoin will be using as much electricity as Denmark.

“Po oceni Digiconomist.net je ta na letni ravni trenutno kar strašljiva – primerljiva s porabo električne energije celotne Danske.”

Kako naj to razumem? Ali recimo mesečna poraba ni strašljiva? In ni primerljiva z Dansko?

Glede na to, da se dnevna poraba energije za rudarjenje zelo hitro povecuje, so na digiconomistu preracunali to na letno raven (ce bi bila 365 dni v letu enaka) in to primerjali z letno porabo Danske. Seveda je to isto kot trditev, da je trenutna dnevna poraba energije za bitcoinsko rudarjenje enaka porabi Danske povpreceni preko leta.

Ja, hvala. Se opravičujem, če sem bil zoprn. Če se le da, se držim načela, da tisto, kar je odveč, samo moti.

Nisem ravno poseben poznavalec Bitcoinov in tudi ne nadvušenec nad njimi, ampak ali ni tako, da se kriptografska zahtevnost rudarjenja blokov sproti prilagaja glede na ponudbo in povpraševanje? Wikipedia pravi: Every 2,016 blocks (approximately 14 days at roughly 10 min per block), the difficulty target is adjusted based on the network’s recent performance, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network Se pravi, da bo šlo za rudarjenje približno toliko elektrike, kot so vredni novonastali bitcoini. Teh… Beri dalje »

Pa še to: energija je bolj ali manj neodvisna od števila transakcij, tako da pojem energija na transakcijo in primerjava z Viso nimata veliko smisla. Energija se troši enostavno za vzdrževanje verige, s transakcijami ali brez.

Nekaj drugega bo, če se bodo v prihodnosti rudarji vzdrževali s provizijami od transakcij. Takrat bo res vrednost elektrike proporcionalna pobranim provizijam.

Ker je precej podatkov na voljo online, sem na hitro preračunal, da bitcoin omrežje trentno porabi približno toliko el. energije kot cela Slovenija( 1.4TW).

Sicer pa Bitcoin algoritem omogoča, da se rudarjenje zmanjša npr za desetkrat, pa bodo prenešenih še vedno isto število transakcij, samo težavnost se bo zmanjšala tako, da bodo transakcije še vedno na 10 minut.

Drugače pa mislim da, je primerjava med visa transakcijo in bitcoinom nerealna, visa namreč ne deluje sama od sebe, potrebno je upoštevati cel sistem s pripadajočimi plačami. Tako da je hitro jasno zakaj gre nekaterim zadeva zelo v nos.